54+ what percentage of gross income should go to mortgage

Web A fairly established and well-known piece of wisdom the 28 rule also known as the 2836 rule advocates that homeowners should spend 28 of their gross. Even with this 43 threshold lenders generally require a more.

What Percentage Of Your Income To Spend On A Mortgage

Web Cadence Bank What Percentage of Income Should Go to Mortgage.

. Web Most lenders agree that if you have debt such as credit card bills or a car payment no more than 28 percent of your monthly gross income should go toward. Web Find your monthly gross income by reviewing your recent paystubs. Compare More Than Just Rates.

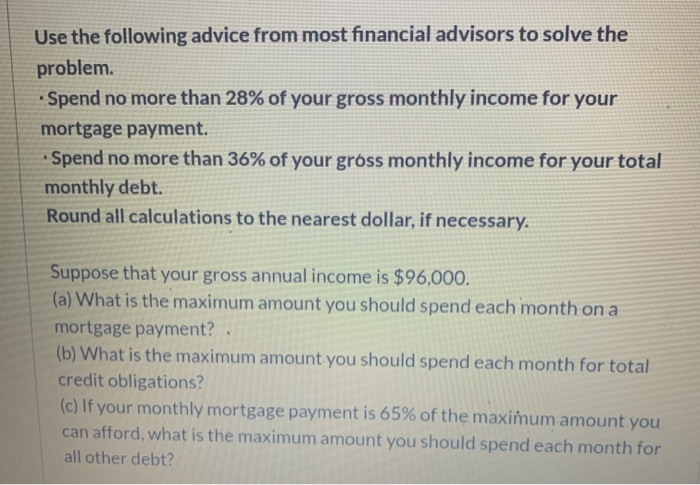

Use Our Tool To Find Out If You Qualify. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including. Or 45 or less of your after-tax net income.

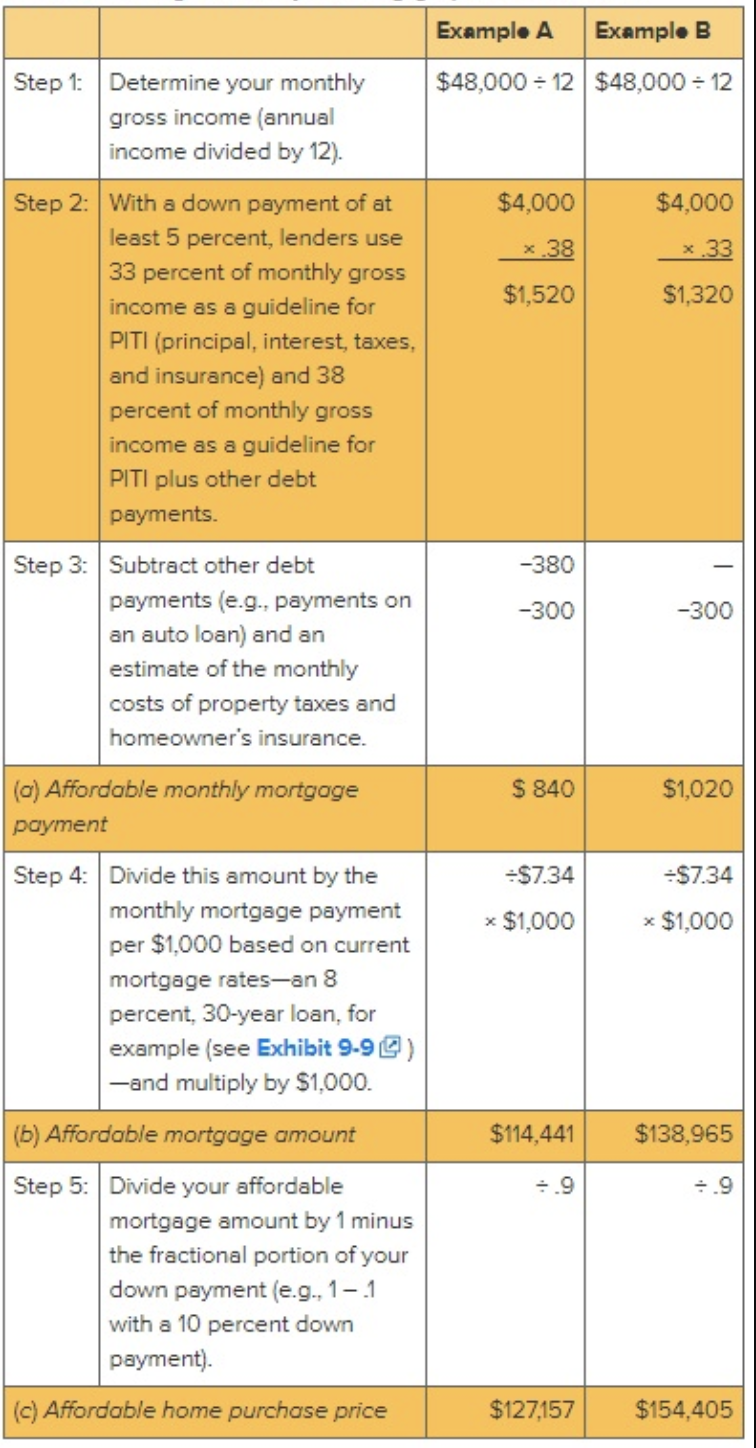

Your total monthly inescapable obligations including PITI should be 35 or less of your pre-tax gross income. Web As a customary rule 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage. Highest Satisfaction for Mortgage Origination.

Apply Online To Enjoy A Service. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. Web The 3545 model.

Find A Lender That Offers Great Service. What percentage of income should mortgage be. Web Most lenders must follow strict policies that limit a mortgage payment to a lower percentage that commonly being 28 percent.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Ad Calculate Your Payment with 0 Down.

Ad Compare Mortgage Loan Rates Offers for 2022 000 Federal Reserve Rate Top Choice. Ad Compare Loans Calculate Payments - All Online. How Much You Can Save.

Then multiply that number by 028 to find the maximum you should be spending on your mortgage. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. Compare More Than Just Rates.

Save Time Money. Apply Get Pre-Qualified in 3 Minutes. Ad Get Instantly Matched With Your Ideal Home Loan Lender.

The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage. Updated FHA Loan Requirements for 2023. Ad Take the First Step Towards Your Dream Home See If You Qualify.

Web This model states that your. However lenders prefer a debt. Keep your mortgage payment at 28 of your gross monthly income or lower.

Check Your Official Eligibility Today. Web The front-end ratio also known as the mortgage-to-income ratio is the percentage of your gross monthly income that you spend on your mortgage payment. Ad 5 Best House Loan Lenders Compared Reviewed.

The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income. Comparisons Trusted by 55000000. Keep your total monthly debts including your mortgage.

Web What percent of income should go to mortgage. Estimate your monthly mortgage payment. Web When determining what percentage of income should go to mortgage a mortgage broker will typically follow the 2836 RuleThe Rule states that a household should not spend.

Mary has an average. Web The 28 Rule. Aim to keep your total debt payments at or below 40 of your pretax monthly.

Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most. Best Mortgage Lenders in Kansas. As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment.

Web The Bottom Line. Find A Lender That Offers Great Service. Whats an ideal mortgage-to-income ratio.

Ad See how much house you can afford.

Solved Use The Following Advice From Most Financial Advisors Chegg Com

Nigerian Sustainable Finance Roadmap By Fc4s Issuu

The Jobs Report In Light Of What Powell Said The Fed Cannot Create Supply Of Labor But It Can Slow The Demand For Labor Wolf Street

Percentage Of Income For Mortgage Rocket Mortgage

Improving Public Sector Service Delivery A Developing Economy Experience Emerald Insight

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What Percentage Of Income Should Go To A Mortgage Bankrate

Percentage Of Income For Mortgage Payments Quicken Loans

Business Succession Planning And Exit Strategies For The Closely Held

Learn Vest Financial Confidence Curve

Solved Exampl A Exampl B 48 000 12 48 000 12 Step 1 Chegg Com

What Percentage Of Income Should Go To A Mortgage Bankrate

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Debt How Do I Account For Monthly Expenses When Calculating How Much House I Can Afford Personal Finance Money Stack Exchange

What Percentage Of Income Should Go To Mortgage

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports